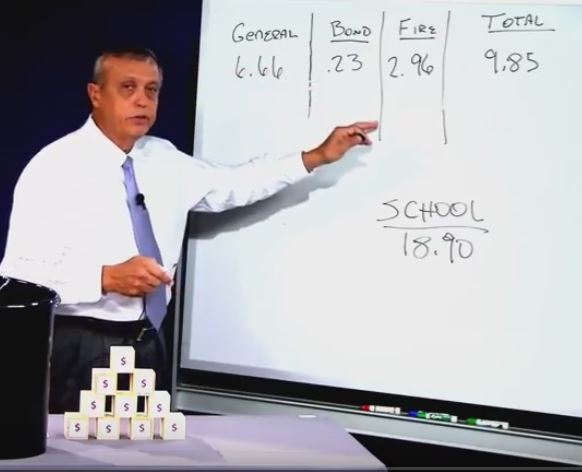

The Cobb County Board of Commissioners has tentatively adopted a millage rate which will require an increase in property taxes of 10.20 percent. This tentative increase will result in a millage rate of 6.890 mills, an increase of 0.638 mills. Without this tentative tax increase, the millage rate will be no more than 6.252 mills. The proposed tax increase for a home with a fair market value of $275,000.00 is approximately $63.80 and the proposed tax increase for non-homestead property with a fair market value of $375,000.00 is approximately $95.70.

Cobb County’s Board of Commissioners will decide later this month whether or not to increase property taxes in the county by 10 percent. Commissioners held two public meetings to discuss the tax increase this week. A third will be held at 7 p.m. on Tuesday, July 25.

Click here to view the July 10 Millage Hearing in which Commissioner Boyce’s video was presented. This video will also be shown at the four town halls. Additionally, it will be shown at the last public hearing on the night of Tuesday, July 25th. “I would encourage you to take the time to view the video to understand fully this very important issue. This topic is way too important for your opinion to be shaped by a sound bite or headline,” says Commissioner Boyce.

Below are the dates for Commissioner Boyce’s town halls:

7 p.m., Monday, July 17

West Cobb Senior Center, 4915 Dallas Highway, Powder Springs

7 p.m., Wednesday, July 19

East Cobb Senior Center, 3332 Sandy Plains Road, Marietta

11:30 a.m., Saturday, July 22

Thompson Community Center (in Thompson Park, 555 Nickajack Road, Mableton)

7 p.m., Monday, July 24

North Cobb Senior Center, 4100 South Main St., Acworth (GPS address: 3900 South Main St, Acworth).